Why ODD Tracking Still Feels Unclear, Even After Teams Add Tools

How ODD tracking can remain fragmented after teams adopt new tools, and why purpose-built due diligence platforms restore visibility

Digitize your:

- Operational Due Diligence

- Investment Due Diligence

- Manager and Third Party Monitoring

Key AI features empower your team to work smarter and faster, saving time and effort.

Automatically pull key information from ADV filings, policies, and reports to pre-fill DDQs or create manager profiles, no copy-paste required.

Use natural language to query one or multiple documents directly. Compare responses, check facts, and surface key data in seconds.

Sidekick highlights missing information, flags contradictions, and scores sentiment across operational, or investment responses.

Get intelligent follow-up question prompts based on Sidekick’s analysis of manager responses, so you can save time without losing rigour.

Our expanding integrations ensure a smooth flow of data across platforms. Plus, our Form ADV solution simplifies regulatory reporting by seamlessly incorporating relevant data.

Create questionnaires using templates, ingest pre-filled forms, and use AI tools to extract and populate data in minutes.

Set your own pre-defined flags and alerts to track risks within funds or managers.

Fully customize Dasseti COLLECT to match your workflows, with AI tools to enhance precision and speed.

Our advanced review module helps you deep dive into specific managers, third parties or funds.

Automated scoring and AI powered comparison tools helps you understand your managers and funds at a glance.

Flexible, branded, automatic report creation using any data point. Link directly to your CRM or database too.

Managers tell our clients that the response portal is user friendly and intuitive. They can even pre-fill from previous answers.

Outlook and SharePoint integrations let you track contacts, emails and shared documents.

Enhance your operational due diligence process. Dasseti COLLECT links directly to your CRM or database, automatically collecting files and scheduling questionnaires, emails and reminders.

Use AI to interrogate documents and compare responses.

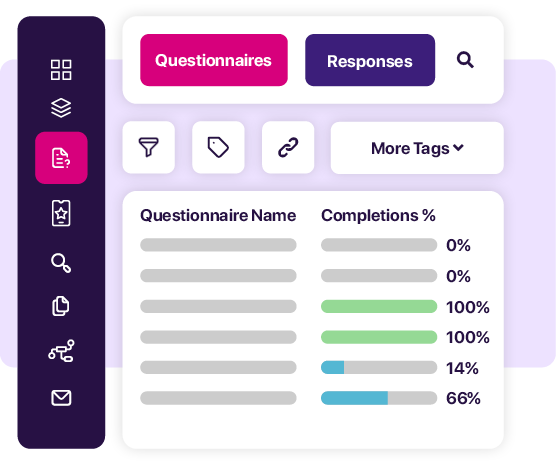

Monitor progress and tag communication with your managers. Add rules, flags and scoring. Collaborate with colleagues and gain deep insights into responses with real-time analytics.

Keep investment portfolios on track by digitizing your investment due diligence process. Use Dasseti COLLECT to perform due diligence on your investment portfolio, quickly and easily. Set your own flags, scores and alerts. Use AI to interrogate documents and easily compare previous responses to show what's changed.

Regular, consistent monitoring of investment managers is essential for investors, investment consultants and other asset owners.

Dasseti COLLECT makes it easier than ever to maintain regular dialogue with your managers. Send regular requests for information and use AI to easily compare responses.

Empower your analysts, investment teams and risk and compliance teams with rich data that can be compared and analyzed as easily as quantitative data.

Bring order and efficiency to investment research with a solution that flexes to fit your specific workflows.

Regulators are beginning to pay closer attention to the delegation of investment management functions. In Luxembourg and Ireland particularly, there is specific guidance on how managers are expected to maintain oversight of a delegate or counterparty. Dasseti COLLECT is an ideal platform for delegate oversight, initial due diligence, deep dive qualitative due diligence and ongoing due diligence.

Sub-advisors bring specific expertise and track record to support an investment portfolio. Ensure you have the very latest profiles across your sub-advisor landscape with Dasseti COLLECT, the leading due diligence platform.

Dasseti ESG has been designed to support ESG metric collection, aggregation and analysis for LPs, Fund of Funds and GPs investing across the private markets.

Dasseti ESG helps firms to collect the data needed for multiple frameworks and reporting templates including ILPA, AIMA, ACC, GRI, EDCI, CSRD, SFDR and SEC Climate-Related Disclosures and many others.

FEG Investment Advisors uses Dasseti COLLECT to gain visibility into diversity and inclusion metrics across the manager universe.

You can digitize and send questionnaires in minutes, automate reminders, flag risks in responses, and populate reports, all while centralizing emails, documents, and meeting notes in one place.

Yes. Dasseti COLLECT uses Smart Docs to extract structured data from PDFs, Word files, and ADV filings. Responses can be pre-filled and verified, reducing responder fatigue and improving data consistency.

Absolutely. Dasseti COLLECT uses Azure OpenAI with zero data retention, SOC 2 Type II compliance, and has been penetration-tested and approved by global allocators.

Yes. Dasseti COLLECT structures all collected data so you can run comparisons across time periods, strategies, or risk indicators, with embedded analytics and customizable dashboards.

The Form ADV suite automatically tracks and highlights changes, flags risks, and centralizes fund-level data in one dashboard with customizable alerts.

Yes. You can automate the creation of investment or ODD reports using the Smart Writer tool, directly pulling from structured responses and source documents to build IC-ready or stakeholder reports.

Generic AI tools aren't built for due diligence. Dasseti COLLECT’s Sidekick AI is embedded into the full workflow—auto-populating DDQs, flagging inconsistencies, linking answers to profiles, and generating audit-ready outputs with traceable sources.

Dasseti’s AI is already live, trusted by institutional allocators, and deeply embedded in due diligence workflows. Building your own means taking on security, compliance, and maintenance challenges that Dasseti already solves at scale.

Sidekick is “data-first.” It doesn’t just respond to one-off prompts. It powers workflows, scales across recurring reviews, and integrates with ADV filings, scoring models, and risk dashboards - built for real-world due diligence, not just chat.

Dasseti COLLECT is the best way of getting reliable data directly from GPs on their operations or the underlying entities.

How allocators can streamline due diligence, improve data quality, and make better use of AI - without overwhelming managers or losing control of the process.

Hosted by Aurelien Poulet, Head of Client Solutions, and Fiona Sherwood, CMO

How allocators can design due diligence questionnaires that improve manager engagement and generate cleaner, more usable data.

Step by step guide to taking your ODD process to the next level.

How ODD tracking can remain fragmented after teams adopt new tools, and why purpose-built due diligence platforms restore visibility

How fragmented ODD tracking creates oversight visibility gaps, and how embedding status inside the workflow improves clarity, governance, and control.

The pressure in ESG reporting sits downstream - where disparate data must be normalized, validated, and made disclosure-ready.

Contact us to discuss your exact requirements