Dasseti Wins Solution Provider of the Year: ODD

Dasseti won Solution Provider of the Year - ODD at the 2026 Private Equity Wire European Awards. Here's what the recognition reflects about where...

Private market investors can't afford to wait for perfect ESG data. This webinar provides practical solutions for filling data gaps, mitigating risks, and making informed investment decisions with the best available tools and technology.

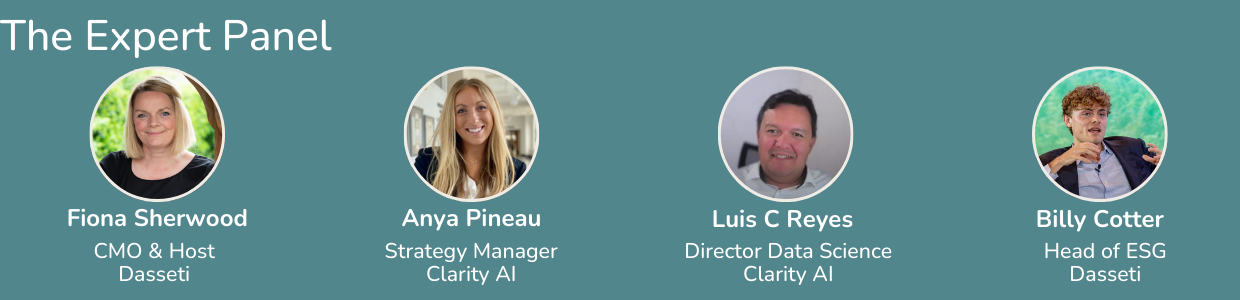

The demand for accurate ESG data in private markets is higher than ever, but data gaps and reporting inconsistencies remain a challenge. In this webinar in collaboration with Clarity AI, we explore how investors can leverage technology, benchmarks, and proxy data to enhance sustainability reporting and decision-making - without letting perfection become the enemy of good.

Private Credit Firms, LPs, GPs, Fund of Funds: Analyze, manage and integrate ESG metrics into your investment processes and make short work of reporting.

Download the market research report featuring Dasseti

Dasseti won Solution Provider of the Year - ODD at the 2026 Private Equity Wire European Awards. Here's what the recognition reflects about where...

Discover why ESG reporting strains peak in Q2 and how continuous data capture and early validation can improve your ESG processes.

How manual DDQ tracking creates hidden friction for ODD teams as volumes grow and why spreadsheet-based processes struggle to scale.