ESG funds are seeing incredible inflows – but why?

Environmental, social and governance (ESG) funds have never been more popular, attracting record cash flows.

In the first two quarters of 2020, cash flows to sustainable funds exceeded $20 billion. That amount nearly matches 2019’s record-setting full-year total — in just six months.

According to mutual fund analysts Morningstar, ESG funds topped $1 trillion in assets under management in August.

Market analysts see these trends continuing. Deloitte predicts that by 2025, ESG-mandated assets could make up half of all managed assets in the U.S., reaching $34 billion.

Experts and industry leaders say the massive growth in ESG investment is due to the immediate economic fallout as a result of the COVID-19 pandemic. Others attribute growing awareness in social and societal issues, such as police and protestor violence and racial and class inequality.

Lastly, many believe that ESG investment has simply been a consistent trend in the market.

How did the pandemic accelerate ESG growth pace?

Economic recession

There’s no doubt that the coronavirus pandemic has upended nearly every part of the economy. It decimated extractive industries, such as energy, while promoting growth in ESG-focused sectors, including consumer staples, health care and technology.

By late August, the S&P 500 ESG Index, comprised of large U.S. companies with high ESG ratings, returned 10.5% year-to-date versus just 7.67% for the S&P 500 Index.

Social unrest

Tensions surrounding societal and racial inequality have triggered a global conversation about businesses’ responsibility to society in the areas of racial and economic diversity. ESG investors are now increasing weight to social and governance performance.

“The pandemic has taught us that if businesses are to defend against future shocks, protect workers and ultimately support long-term growth, the social element within ESG should be considered just as critical as environmental and governance factors,” said Naïm Abou-Jaoudé, CEO at Candriam Investors Group and chairman of New York Life Investment Management International.

A recent Financial Times survey of UK wealth managers found that nearly nine in 10 managers believe the COVID-19 pandemic would result in increased investor interest in ESG funds.

4 reasons why investors have been considering ESG funds

ESG was growing fast before the pandemic, driven by fundamental changes in the investment landscape.

Here are four reasons for why this has been the case, and why we’ll continue to see ESG fund inflows:

1. The desire for more sustainable business models: Even before the pandemic, investors recognized the risks companies took — in environmental disasters, lawsuits, boycotts, poor governance and negative publicity — by not monitoring ESG compliance. But the disruption caused by COVID-19 further accentuated the importance of “building sustainable and resilient business models based on multi-stakeholder considerations,” according to Morningstar.

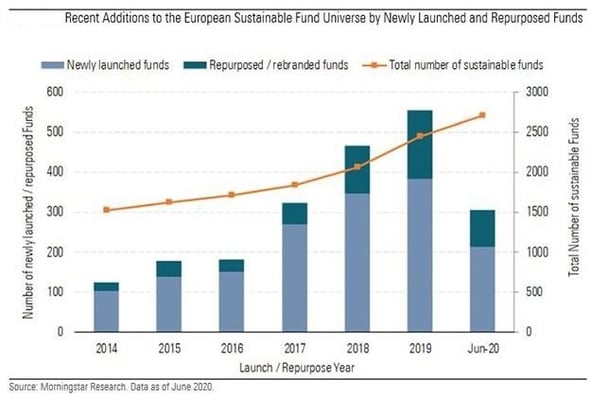

2. Product availability: ESG funds are more accessible than ever before — across asset classes and investments. The number of available products in the sustainable fund universe has attracted more investors. In the second quarter of 2020 alone, fund managers launched or adapted more than 100 funds and ETFs to pursue ESG objectives, increasing ESG vehicles from 2,584 to 2,703, according to Morningstar data.

Asset managers have continued the process of extending their green offerings. In the second quarter, 40 traditional funds were converted into sustainable funds.

3. Product validation: As more investors buy ESG assets, products and prices become further justifiable. Today fees on sustainable funds and ETFs are often competitive with non-ESG funds.

4. Better business practices: The tactics that companies employ to improve their ESG ratings — carefully monitoring supply chains, environmental impact and employee practices — also reduce investment risk, according to BlackRock research. The disruption caused by the pandemic has highlighted the importance of building sustainable and resilient business models.

Regardless of the reasons for the increased inflows in ESG funds and their outperformance in the last months, John Rekenthaler, Vice President of Research at Morningstar, asserts that ESG investing has already become mainstream in some countries and has been adopted by some of the biggest players in the market.

Larry Fink, CEO of BlackRock, sees even more growth ahead. In a recent speech on climate change and ESG investing, he explained that “the idea companies have a greater purpose besides just providing returns for shareholders would soon become even more important.”

Does ESG investment come at the expense of performance?

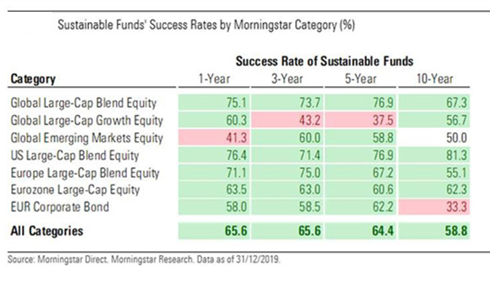

Traditionally, many investors have insisted that financial performance should be their sole objective and that there is a penalty associated with ESG investing. But data and analysis from Morningstar shows that this is not the case in many asset classes.

The long-term performance of a sample of 745 Europe-based sustainable funds shows that the majority of strategies have done better than non-ESG funds over one, three, five and 10 years.

A majority of surviving sustainable funds (those that existed 10 years ago and still exist today) outperformed their average surviving traditional peer.

As ESG gains a longer track record, increasing analysts believe that data will prove these factors contribute positively to performance.

According to BlackRock, 88% of a globally-representative selection of sustainable indices outperformed their non-sustainable peers over the first four months of this year.

ESG portfolios’ low exposure to fossil fuel assets has contributed to their good performance lately and reduced the impact of the oil price collapse at the beginning of 2020.

Over the longer term, avoiding companies with environmental, social and governance problems appears to add to, not diminish, investor returns.

ESG in a post-COVID world

A sustained global economic downturn or a rash of bankruptcies might very well test companies’ commitment to sustainability goals. But it’s too early to say.

However, over time and through most market cycles, it seems clear that good ESG practices are good business practices. As the world recognizes this fact, all investors might become ESG investors.

Selecting the right ESG strategy or manager has a significantly different approach from hiring a manager for conventional mandates.

For more information, read Dasseti's previous article on how sustainable investing impacts investment managers screening and monitoring activities.

Dasseti helps investors and consultants assess fund managers based on ESG criteria. Our solution enables centralizing, digitizing, and automating the collection of data related to ESG and performing the analysis/comparison. If you would like to check how Dasseti can ease your ESG manager due diligence, send us the request for a demo, and try the solution free of charge.